7starhd Movies Hd

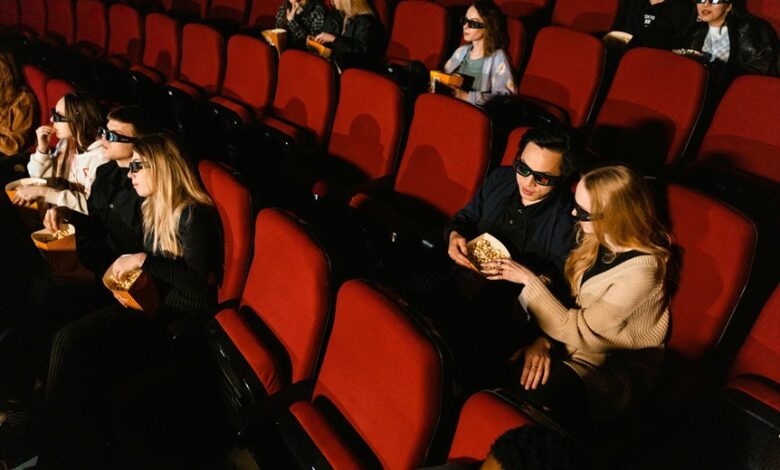

7starhd Movies HD presents a compelling option for film enthusiasts seeking a vast array of viewing choices. Its user-friendly interface and high-quality visuals enhance the experience, yet potential legal and cybersecurity risks accompany its use. Understanding these factors is crucial for users who wish to navigate this platform safely. What precautions should one consider while engaging with such streaming services, and how can they fully optimize their experience without compromising their security?

Features of 7starhd Movies HD

One of the defining characteristics of 7starhd Movies HD is its extensive library that offers a diverse range of films across various genres.

The platform is known for its high streaming quality, ensuring viewers enjoy a clear and immersive experience.

Additionally, the user interface is designed for simplicity, allowing easy navigation, which enhances the overall user experience and promotes accessibility to a wide audience.

Benefits of Using 7starhd Movies HD

Numerous advantages accompany the use of 7starhd Movies HD, making it a popular choice among movie enthusiasts.

The platform offers exceptional streaming quality, ensuring viewers enjoy a visually appealing experience. Additionally, its user experience is streamlined and intuitive, allowing easy navigation through vast content.

This combination of high-quality visuals and user-centric design enhances overall satisfaction, fostering a loyal user base seeking freedom in entertainment choices.

Potential Risks and Considerations

While 7starhd Movies HD offers an appealing user experience and high-quality streaming, potential risks and considerations warrant careful examination.

Users must be aware of legal implications surrounding copyright infringement, which can lead to significant penalties.

Additionally, cybersecurity threats such as malware and phishing attacks pose risks to personal data.

Therefore, exercising caution and being informed is essential for a safe viewing experience.

How to Access 7starhd Movies HD

How can users effectively navigate the complexities of accessing 7starhd Movies HD?

To enhance their experience, individuals should familiarize themselves with various access methods, such as VPNs or proxy servers, to bypass restrictions.

Additionally, mastering website navigation is crucial, as it enables users to locate desired content efficiently.

Understanding these elements can empower users to enjoy a more liberated viewing experience.

Conclusion

In summary, 7starhd Movies HD stands as a digital treasure trove for film enthusiasts, offering a diverse array of cinematic experiences. However, users must tread carefully, navigating the shadows of copyright issues and cybersecurity threats. By utilizing protective measures such as VPNs, viewers can safeguard their journeys through this vibrant landscape of entertainment. Ultimately, while the allure of high-quality content is undeniable, vigilance remains the key to an enjoyable and secure viewing experience.