Viral Tips.Online

Viral Tips.Online serves as a vital resource for those navigating the complexities of the digital realm. It offers practical insights into enhancing online visibility and engaging audiences effectively. As trends shift rapidly, understanding these dynamics becomes crucial for success. Users are encouraged to adapt and innovate, but what specific strategies can yield the most significant impact? The answers lie within the evolving landscape of digital marketing.

Understanding the Importance of Digital Trends

As digital landscapes evolve, understanding the importance of digital trends becomes essential for individuals and businesses alike.

Digital consumer behavior is rapidly shifting, influenced by emerging technologies that reshape interactions and expectations.

By analyzing these trends, stakeholders can adapt strategies to meet changing demands, fostering innovation and connection.

Embracing this knowledge empowers freedom, allowing for proactive engagement in an ever-changing digital marketplace.

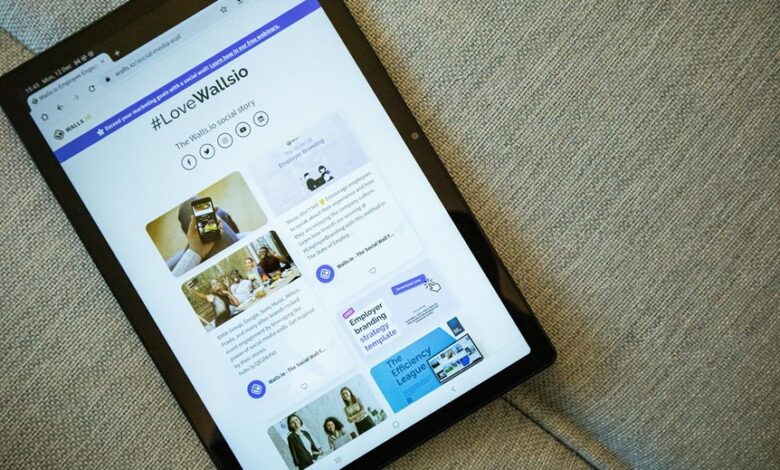

Strategies for Enhancing Your Social Media Presence

To effectively enhance social media presence, individuals and brands must first understand the unique dynamics of each platform.

Strategic content creation tailored to audience preferences fosters genuine audience engagement. By analyzing interactions and adapting strategies, users can cultivate a vibrant online community.

Embracing authenticity and creativity allows for deeper connections, ultimately elevating visibility and influence across social media landscapes.

Techniques to Boost Website Traffic

Unlocking the potential for increased website traffic requires a multifaceted approach that combines strategic planning and data-driven insights.

Effective SEO optimization enhances visibility, while robust content marketing engages and retains audience interest.

Staying Informed: Continuous Learning in the Digital World

In the rapidly evolving digital landscape, staying informed is paramount for anyone seeking to maintain a competitive edge.

Engaging in online courses facilitates continuous learning, empowering individuals to navigate changes effectively.

Regular knowledge updates through credible sources enhance strategic decision-making, allowing freedom to adapt in a fast-paced environment.

Embracing this journey of learning ensures relevance and resilience in the digital world.

Conclusion

In conclusion, embracing the dynamic nature of digital trends is crucial for success in today’s marketplace. With 54% of social media users reporting that they use platforms to research products, businesses must prioritize their online presence and engagement strategies. By adopting innovative techniques to boost website traffic and committing to continuous learning, individuals and organizations can effectively navigate the digital landscape. This proactive approach not only enhances visibility but also fosters meaningful connections with audiences, driving long-term growth.